Redefining Business Finance: The Concept of Dismoneyfied

In today’s rapidly evolving economic landscape, traditional views of business finance are being challenged by innovative approaches that emphasize simplification and transparency. The term “dismoneyfied” encapsulates this transformation, focusing on moving away from complex financial concepts that often intimidate entrepreneurs. It advocates for a fresh perspective on financial management that bridges the gap between intricate financial principles and practical, everyday business operations.

The conventional understanding of business finance often involves a labyrinth of numbers, formulas, and regulations that can overwhelm even seasoned professionals. Entrepreneurs frequently find themselves perplexed by cash flow statements, balance sheets, and profit-and-loss reports. This complexity can lead to poor financial decision-making and hinder the growth of small to medium-sized enterprises (SMEs). Dismoneyfied aims to dismantle these barriers, making financial processes more approachable and easier to manage.

By redefining finance in a manner that prioritizes clarity and accessibility, businesses can cultivate a more empowering atmosphere for entrepreneurs. This concept emphasizes actionable insights over convoluted data, allowing for straightforward interpretation and decision-making based on current financial realities. Instead of viewing financial management as an insurmountable challenge, business leaders can start to see it as a vital component of their strategy, one that enhances their operational effectiveness.

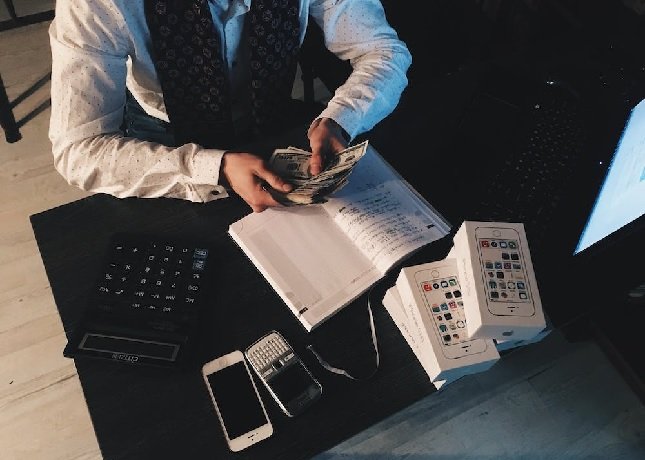

Real-life applications of the dismoneyfied concept include the adoption of technology-driven solutions such as user-friendly financial software and automated budgeting tools. These innovations enable business owners to track their finances effortlessly, allowing for better forecasting and resource allocation. By embracing such methodologies, companies can demystify their financial operations, leading to increased agility in an ever-changing business environment.

Overall, redefining business finance through the lens of “dismoneyfied” presents a unique opportunity for entrepreneurs to simplify their financial management, leading to better-informed decisions and ultimately more successful enterprises.

Building Your Business Framework: Essential Steps in Dismoneyfied Practices

To effectively incorporate dismoneyfied practices into your business framework, it is crucial to start by examining how traditional methods of budgeting, forecasting, and financial planning can be redefined. The initial step involves developing a clear understanding of your business goals and objectives. By identifying these goals, you can create a more tailored financial strategy that does not adhere strictly to outdated practices.

Next, consider implementing a zero-based budgeting approach. This technique requires businesses to start from scratch when planning their budgets, rather than relying on previous years’ figures. By justifying every expense, a focus on necessary costs emerges, which can lead to greater efficiency and aligned resource allocation. This aligns perfectly with the principles of the business guide dismoneyfied, as it emphasizes making informed financial decisions that directly contribute to growth and sustainability.

Additionally, enhancing forecasting accuracy is integral to a robust business framework. Utilizing advanced analytics tools can allow you to predict financial trends more accurately and create responsive strategies. Regularly revisiting your forecasts should become a routine practice, enabling you to adjust your tactics promptly in response to market changes. By embracing a flexible approach to financial projections, you can safeguard your business against unforeseen challenges, reinforcing the dismoneyfied approach.

Moreover, financial planning should prioritize risk assessment and management. Identifying potential threats and opportunities allows businesses to devise contingency plans that are not only reactive but also proactive. This approach encourages resilience within the business framework while ensuring financial stability and long-term growth.

In conclusion, by integrating these essential steps into your business framework, you can successfully implement dismoneyfied practices. This holistic approach fosters an environment that emphasizes sustainable growth through more effective financial management strategies.

Technology & Tools: Revolutionizing the Dismoneyfied Approach

The integration of technology into business finance has brought about transformative changes, particularly within the dismoneyfied framework. The dismoneyfied approach emphasizes clarity and accessibility in financial management, making it essential for businesses to utilize the right technological tools. These tools not only simplify the recording of transactions but also facilitate advanced analysis of financial data, enabling better decision-making processes.

One of the most critical aspects of adopting a dismoneyfied approach is the selection of appropriate software solutions. Tools such as cloud-based accounting software enable businesses to manage finances in real time, providing an up-to-date overview of their financial health. Popular platforms like QuickBooks, Xero, and FreshBooks offer user-friendly interfaces that demystify financial reporting for users of all levels. With features that include automated invoicing, expense tracking, and real-time financial reporting, businesses can enhance their operational efficiency and gain deeper insights into their financial standing.

Moreover, utilizing data visualization tools can significantly improve financial literacy. Applications such as Tableau and Microsoft Power BI help transform complex financial data into intuitive visualizations, empowering business owners and managers to understand their financial metrics at a glance. Such insights are crucial for budgeting, forecasting, and strategic planning, aligning with the goal of making business finance less daunting.

Finally, in choosing the right technology, businesses must consider scalability. As organizations grow, their financial management needs evolve, and scalable solutions can adapt to these changes without losing functionality. Embracing the technology available within the dismoneyfied business guide will not only streamline operations but also foster a culture of financial transparency and understanding among stakeholders.

Real-Life Success Stories: Businesses Thriving with Dismoneyfied Principles

In the rapidly evolving landscape of business, some enterprises have distinguished themselves by adopting dismoneyfied principles, resulting in remarkable transformations. These success stories illustrate the practical impact of innovative financial strategies on organizational performance. One compelling example is a mid-sized technology firm that faced stagnating growth due to traditional financial practices. By rethinking their approach to budgeting and resource allocation, they implemented a dismoneyfied strategy that emphasized flexibility and data-driven decision-making. This transition not only streamlined their financial operations but also facilitated a 30% increase in revenue over two years, showcasing the power of a dismoneyfied mindset.

Another notable case involves a family-run restaurant that struggled with managing monthly expenses and fluctuating customer demand. By adopting the dismoneyfied principles, the owners transformed their financial management approach. They incorporated a more agile pricing model and invested in customer analytics tools, enabling them to better align their offerings with market trends. This strategy yielded an impressive 25% increase in profit margins and significantly enhanced customer satisfaction, proving that even small businesses can thrive by embracing these innovative practices.

Finally, consider the journey of a startup that initially experienced challenges in cash flow management. By applying dismoneyfied approaches to their funding strategy, the company optimized their capital structure. They focused on reinvesting profits back into growth opportunities rather than relying on external funding sources. This shift not only stabilized their financial footing but also positioned them for sustainable growth. Over three years, they expanded their market share and attracted significant investor interest, illustrating the long-term benefits of cultivating a dismoneyfied financial environment.

These real-life success stories exemplify the tangible results attainable when businesses embrace dismoneyfied principles. By implementing innovative financial strategies, companies across various industries can not only navigate challenges but also unlock new avenues for success.